Real estate markets are notoriously fickle things, and even if you are willing to take on the risk of a mortgage, it might not make the most fiscal sense. At the same time, many of us who are currently renting would actually be much better off buying a home and putting that “rent” money towards paying off the principal of a mortgage. While there are no hard and fast answers as to if and when you should rent or buy, if you systematically address two considerations, you will help yourself make a more informed (and profitable) decision.

Consideration #1: What is the local real estate market like?

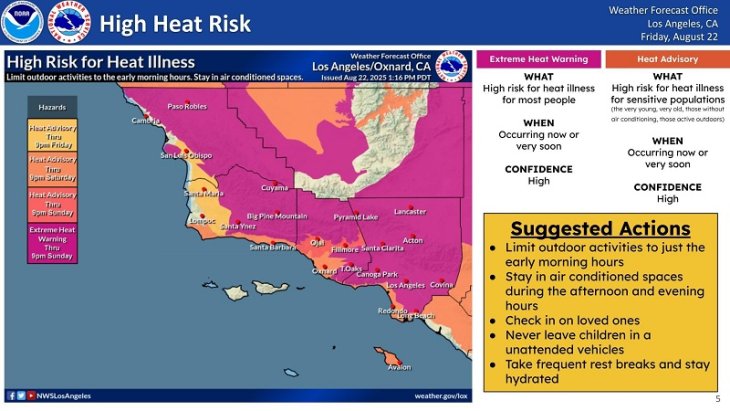

Almost by definition, the value of real estate is dependent upon its location. A person in San Francisco asking themselves, “how much should I spend on rent” will arrive at a far different answer than someone living in rural Illinois. Surprisingly, the question you really should be asking is not so much what you should spend, but what direction the real estate market is likely to go. In up-and-coming cities like Raleigh, Austin, or Nashville, it is a safe bet that if you buy a home its price will appreciate. As with everything, however, there is a catch. If you live in a market that is exploding in value, you will not be the only one who wants to get in on the action. In hot markets where homes sell for above the asking price before they are even listed, you will often need to make a cash offer to be competitive. The general rule of thumb, though, is that if you live in a city that is growing quickly, it is best to buy your own house if at all possible.

The reason is easy to see. Let’s say you buy a house for $150,000 and have a monthly mortgage payment of $800. Let’s also assume that when you buy this house, similar homes are renting for $700. If you are in a market that is growing rapidly, next year the rent will be $750, but your mortgage payment will still be $800. Then the next year the rent will go to $800 – the same as your mortgage. The following year, rent will be $850 while your mortgage payment will still be $800. At the same time as you get to keep your monthly payment steady, you get the equity from the value of your home increasing in the hot market.

Hooray! So why do we not just all go and buy homes no matter what? Well, the problem is that the same principle works the other way. If your market goes down, then you can find yourself underwater – that is, owing more on your home than your home is even worth. That can spell financial ruin, so be sure to talk to a real estate professional about local market conditions while you weigh what option is best for you.

Consideration #2: How much do I have saved and how much am I likely to make in the future?

If the first thing you want to think about is the cost side of the equation, it makes sense that the second is the income side of it. As with the situation above, cash flow in the future is just (if not more) important than how much you have saved right now. One of the greatest advantages of renting is that you can move to a lower cost of living relatively easily… well, at least easily when compared to owning your home. The other advantage is that you do not need to have nearly as much money saved up. Notice that the ability to change housing costs is related to how much you will make and the ability to afford a place to live is related to how much you have made. You need both sides of the coin. What all this means is that the more you have saved and the more secure your future income is, the more likely it is that you would benefit from buying rather than renting. Of course, the same thing is true the other way around.

There is no magical formula to determine when you should buy a home and when you should rent one; rather, it depends upon your own judgment of the direction the local market is headed and your own finances. It also depends on your willingness to assume risk. Buying a house can be very risky if you do not have enough financial stability – remember that little subprime mortgage crisis in 2007? All that said, by looking closely at your local market and personal finances, you should be far better positioned to make the decision that is right for you.