Just like pizza, medical cannabis can be delivered to your home. However, Board of Equalization (BOE) Chairman Jerome E. Horton warns that sales of medical cannabis are subject to tax in California, and delivery charges that are part of these sales may also be subject to tax.

Even though sales of cannabis are generally taxable, under certain circumstances, tax does not apply to a seller’s charge for delivery of cannabis products from the seller’s place of business directly to the purchaser when the delivery is by an independent contract carrier or common carrier. When the delivery is by facilities other than those of the retailer (e.g., independent contract carrier or common carrier), the sales invoice must clearly list delivery as a separate charge that is not greater than the seller’s actual cost of delivering the cannabis product to the customer. Tax also applies to amounts exceeding the seller’s cost of delivery and to any handling charges.

If the seller does not keep records showing the actual cost of an individual delivery, tax will apply to the seller’s entire delivery charge if it is made in connection with a taxable sale of cannabis products.

“As a seller of cannabis products, you must report your total sales on your sales and use tax return. If your total sales include nontaxable delivery charges, you should take a deduction for those amounts on the line for “Other” deductions. If you don’t take the deduction, you’ll pay more tax than you owe,”Chairman Horton said.

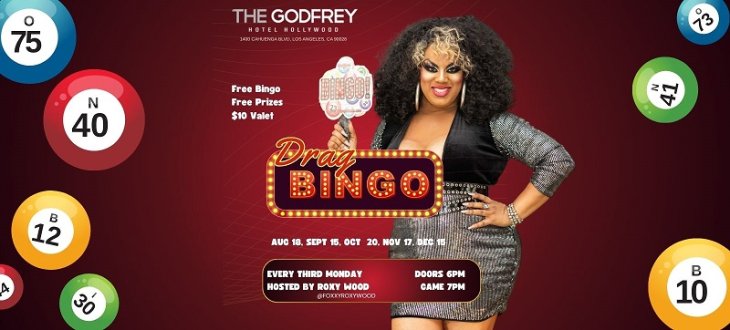

Chairman Horton will host two events in Los Angeles to provide industry specific information and facilitate compliance in the medical cannabis industry:

- Medical Cannabis Telephone Town Hall on Aug. 18 from 3 pm to 4 pm

7166 West Manchester Avenue, Los Angeles, CA 90045

- Medical Cannabis Business Seminar on Sept. 9 from 1 pm to 3 pm

The public is welcome to attend both events. The Telephone Town Hall will provide a brief overview of state and federal requirements and how to access government agencies’ frequently asked questions. Facilitators of the Medical Cannabis Business Seminar will explain how to become registered with the government agencies that require permits or licenses. In addition, an online medical cannabis compliance tutorial series will be available on Chairman Horton’s website by Sept. 26. To obtain more information on the Telephone Town Hall or the Business Seminar, or to register for one of the events, visit www.boe.ca.gov/horton/ or call 888.847.9652.