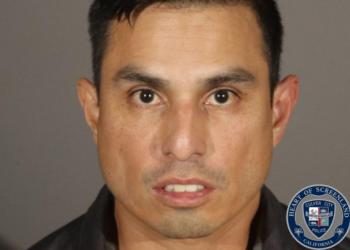

The ex-chief information officer for the Screen Actors Guild’s producers pension and health plan faces up to three years in federal prison when he is sentenced today for filing a false tax return in which he failed to report income from contractors hired to upgrade the plan’s computer system.

Nader Karimi, 51, of Los Angeles, pleaded guilty in November to lying on his 2008 federal tax return, which failed to report about $450,000 in income, according to the U.S. Attorney’s Office.

Over the years 2005 through 2008, Karimi failed to report $711,000 in taxable income, according to his plea agreement.

Karimi was responsible for modernizing the producers pension and health plan’s computer systems, and in that capacity he had the authority to enter into contracts on behalf of the plan, prosecutors said.

During the four-year period, Karimi signed agreements with vendors that agreed to pay a portion of the money they received from the plan to a company affiliated with Karimi, Enterprise Technology and Management Services, according to the plea document.

Karimi used the $711,000 in payments to his company for personal expenses while not declaring them as income on his tax returns, prosecutors said.

“Individuals entrusted with the pension and health care funds of others must be held to the highest standard of conduct,” said Eileen M. Decker, the U.S. attorney in Los Angeles. “The Department of Justice will do everything within its power to bring to justice those who abuse a position of trust for personal gain.”

As part of his plea deal, Karimi has agreed to file amended tax returns, pay back taxes, and make an additional restitution payment of at least $100,000 to the SAG pension and health plan, prosecutors said.