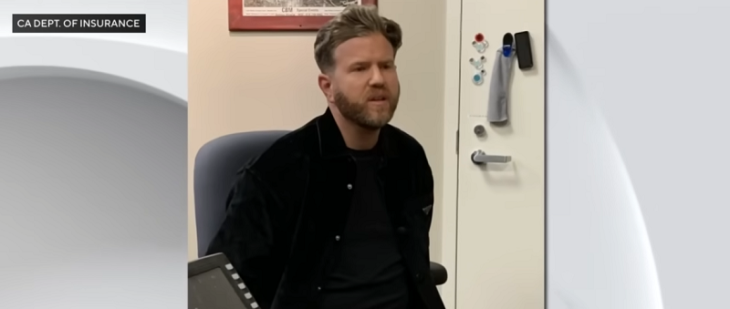

Commissioner Lara Presses State Farm to Justify Rate Hikes and Halt Policy Cancellations

In response to the ongoing insurance crisis and mounting financial instability in the wake of recent wildfires, California Insurance Commissioner Ricardo Lara has conditionally approved State Farm’s request for an emergency interim rate increase. The approval is contingent on the company justifying its request with financial data in a public hearing set for April 8, 2025.

Commissioner Lara is also urging State Farm to halt policy non-renewals and secure a $500 million capital infusion from its parent company to bolster its financial health. He presented this proposal in a recent meeting with State Farm representatives, the California Department of Insurance, and the designated intervenor in the case. The transcript from that meeting was made public this week.

For months, the Department of Insurance engaged in discussions with State Farm and the intervenor to reach a resolution on the company’s rate increase request. However, negotiations stalled when State Farm claimed its financial position had further deteriorated, prompting the company to directly petition Commissioner Lara for an emergency rate hike.

At a February 26, 2025, meeting in Oakland, State Farm representatives assured Lara that they could cover claims from the devastating Southern California wildfires but warned that the disaster had worsened their overall financial condition. Given State Farm’s status as California’s largest home insurer, Lara has pressed the company for a clear strategy to stabilize its financial standing while continuing to serve more than 1 million homeowners in the state.

Commissioner Lara stated the importance of balancing consumer protection with market stability in his response:

“The role of Insurance Commissioner involves balancing a stable and sustainable insurance market that serves consumers with effective oversight. To ensure long-term choices for Californians, I had to make an unprecedented decision in the short term.

“State Farm claims it is committed to its California customers and aims to restore financial stability. I expect both State Farm and its parent company to meet their responsibilities and not shift the burden entirely onto their customers. The facts will be revealed in an open, transparent hearing.

“Currently, too many Californians live in fear of having their insurance policies non-renewed. This anxiety perpetuates misinformation and discourages consumers from accessing their entitled benefits. This situation is unacceptable. I will remain vigilant in ensuring that State Farm processes claims fairly, fully, and promptly, and stands by its California customers.

“To resolve this matter, I am ordering State Farm to respond to questions in an official hearing, promoting transparency and a path forward. It is evident that other California insurers are unable to absorb State Farm’s existing customers, which poses a significant risk of these customers ending up on the FAIR Plan—a scenario we all wish to avoid as my Sustainable Insurance Strategy is implemented.

“We will finally get to the bottom of State Farm’s financial condition. I am confident that my approach will provide Californians with greater choices in a competitive and stable insurance market—exactly what they deserve.”

Pending the outcome of the April 8 hearing, State Farm’s proposed rate hikes are as follows:

- Non-Tenant Homeowners: 21.8%

- Tenant (Renters): 15%

- Tenant (Condominium Unitowners): 15%

- Rental Dwelling: 38%

Despite having received multiple rate increases in recent years, State Farm has ceased issuing new policies in California and non-renewed thousands of existing policies, raising concerns about its financial situation. The upcoming hearing is particularly important, as rate hearings under Proposition 103 are rare. State Farm was also the subject of the last such hearing in 2015.

The outcome of the hearing will determine whether the requested rate hikes are justified or if further regulatory actions are necessary to stabilize the insurance market while protecting California homeowners.