By Tom Elias

Climate change, if you ask most state experts, has already created a wildfire crisis in California. In the process, it’s causing a fire insurance predicament.

“All hell is breaking loose,” was Gov. Jerry Brown’s sum-up on national television of the effects climate change and its wildly variable and unpredictable weather patterns have had in fire-ravaged parts of the state.

Anyone who tuned into broadcast press conferences by top-level firefighters during the blazes of both September and December also heard them bemoaning the changes global warming has brought to their jobs. As Brown noted, with only slight exaggeration, “The fire season used to be a couple of months in the summer; now we’re in December.”

Before 2017, California sometimes saw major wildfires as late as early- to mid-November, but almost never deep into December, a time when the annual rainy season has usually been well under way. But all fall a persistent atmospheric high-pressure ridge prevented rain clouds from moving into much of the state.

One result was fires that lasted weeks, feeding off vegetation that mushroomed after last year’s unusually wet winter and then dried out almost completely, leaving huge amounts of fuel for fires.

Most of the more than 9,500 homes and other structures destroyed in this year’s far longer than usual fire season were insured, some owners paying extra-high premiums because they’re in known fire areas.

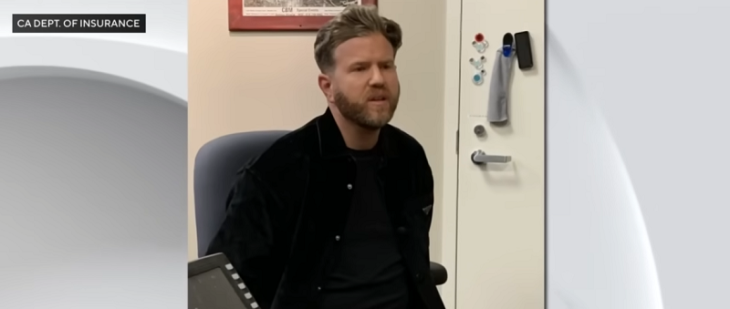

At the height of the infernos, state Insurance Commissioner Dave Jones warned the new year-round threat to homes in many parts of the state could change the entire fire insurance marketplace.

This crisis is real, but it’s not yet widespread even though some homeowners have already gotten notices of non-renewal from insurance companies. Those are likely harbingers of many more to come.

Jones noted in an interview that insurance companies can’t cancel policies during their term. They must also renew policies for homes in fire disaster areas for at least one more year after any current policy expires. But they don’t have to renew policies in non-disaster areas when they expire and they don’t have to renew homes in disaster areas more than one year beyond current policy expirations.

These rules mean there is a crisis, spurred largely by new weather conditions that have broadened areas rated as fire-prone. But this insurance availability crisis won’t look like what happened after the 1994 Northridge Earthquake, when property insurance companies refused to renew many existing policies and stopped writing new home and business insurance in the state. That impasse ended in 1996 with creation of the California Earthquake Authority and elimination of an old rule under which companies writing any property insurance also had to offer quake coverage. The state-run CEA now writes the vast majority of earthquake policies.

“It’s possible some insurers will reduce their willingness to write policies in areas at risk for fires,” Jones said. The state’s Fair Plan, roughly equivalent to the CEA in that it must insure anyone who applies, is the fallback for homeowners in places now deemed fodder for future burns. Fire insurance through the Fair Plan costs more than ordinary policies, although by law prices cannot be excessive. But rates vary according to home replacement values and fire risk.

Before last year’s blazes, the number of Fair Plan policies was rising by about 1,000 per year, Jones reported. That figure climbed in 2017 and likely will again this year. He added that homeowners should view the Fair Plan as a fallback option to be used only if no commercial insurer will cover them.

One factor pushing some insurance companies to stop writing policies might be the 1988 Proposition 103, which forbids them from packing all their costs from last year’s fires into this year’s rates. Instead, compensation for those costs must be spread over 20 years to avoid big financial shocks to homeowners.

Overall, said Jones, “insurers are using more and more sophisticated (computer) models to determine risk factors. Some of those models might cause them to back off writing insurance in some areas.”

All of which means climate change now is impacting wallets, forcing an insurance crisis in both proven and potential fire disaster areas.