Steven F. Brown faces up to 20 years in federal prison

By Staff Writer

A Marina del Rey accountant faces up to 20 years in federal prison after pleading guilty to running a multimillion-dollar Ponzi scheme.

On September 3, the Justice Department announced an accountant has agreed to plead guilty to a federal charge that he ran a $3.3 million Ponzi scheme that falsely promised generous returns for foreign exchange currency investors, and he facilitated the scheme in part with money he embezzled from his former employer.

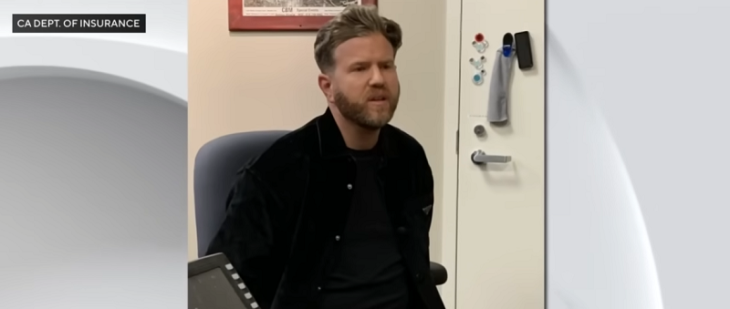

Steven F. Brown, 52, of Marina del Rey, agreed to plead guilty to a one-count criminal information charging him with wire fraud. The criminal information and a related plea agreement were filed on August 28in United States District Court in downtown Los Angeles, where Brown is scheduled to make his initial court appearance on September 15.

According to his plea agreement, Brown controlled and operated Alpha Trade Analytics, Inc., a financial consulting and investment company he largely ran out of his home. Neither Brown nor Alpha Trade was a registered broker or dealer in securities. Brown also served as the accountant for a non-profit organization providing dance and theater arts education to children and young adults in Los Angeles, and had access to its bank accounts.

From April 2014 to May 2018, Brown solicited investments in Alpha Trade, including from people he encountered through his position with his employer, and through his relationship with its executives and employees, which afforded him access to high-net-worth individuals.

To encourage those individuals to invest with Alpha Trade, Brown falsely promised that their investments would only be used for foreign exchange (Forex) currency trading and that they would receive guaranteed monthly payouts of around 10%. He also falsely represented that he had extensive experience in Forex investing, regularly made profitable trades, and achieved substantial and growing rates of return that exceeded the industry average.

Contrary to his representations to investors, Brown only used a small portion of the total amount invested in Alpha Trade for Forex trading, mostly in 2015. Instead, he routinely used investor funds for other purposes, including his rent, car payments, restaurant and retail expenses, and lulling payments to other investors, the plea agreement states.

In order to induce investors to maintain or supplement their investments with Alpha Trade and to conceal his scheme, Brown periodically provided investors with account statements that reflected fabricated investment returns that often showed steady, significant gains.

Brown admitted he made some of the promised recurring payouts and provided demanded refunds, not based on any Forex investment returns, but instead from money stolen from new investors and through funds he embezzled from the dance academy through unauthorized wire transfers, credit card advances, and cash withdrawals he was able to make by virtue of his position as the dance academy’s accountant.

In total, Brown caused losses of approximately $3,313,346 to more than 10 victims, including nearly $700,000 in losses to his former employer based on the money he embezzled from it, according to the plea agreement.

When Brown enters his guilty plea, he will face a statutory maximum sentence of 20 years in federal prison.